ValorBank

An intuitive banking app designed for seamless and streamlined financial experiences

Overview

In today's digital world, there's a huge need for easy-to-use banking apps. My project, ValorBank, shows my dedication to creating a great digital banking experience. The goal was to make a simple, secure, and feature-packed app that makes managing finances easier for users.

Design Challenges and Strategic Solutions

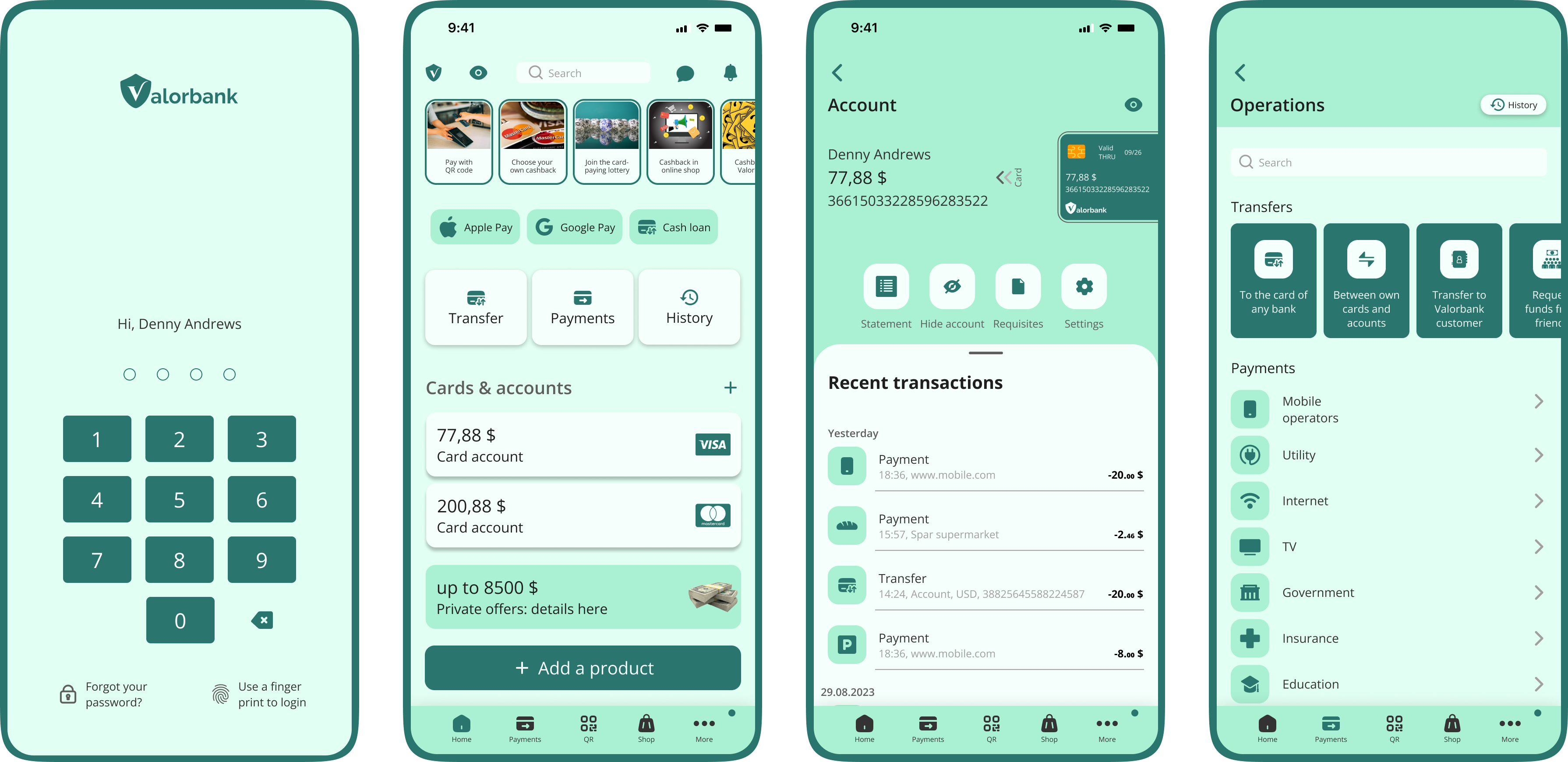

During the development of ValorBank, I encountered several challenges that tested my design and technical skills. One major challenge was creating a user interface that could handle complex banking functions without overwhelming the users. To solve this, I prioritized simplicity in design, using intuitive layouts and minimalistic elements that make navigation straightforward even for first-time users.

Another significant hurdle was ensuring the security of transactions, a critical aspect given the sensitive nature of banking information. To address this, I integrated advanced encryption methods and biometric authentication, significantly enhancing the app’s security framework and giving users peace of mind.

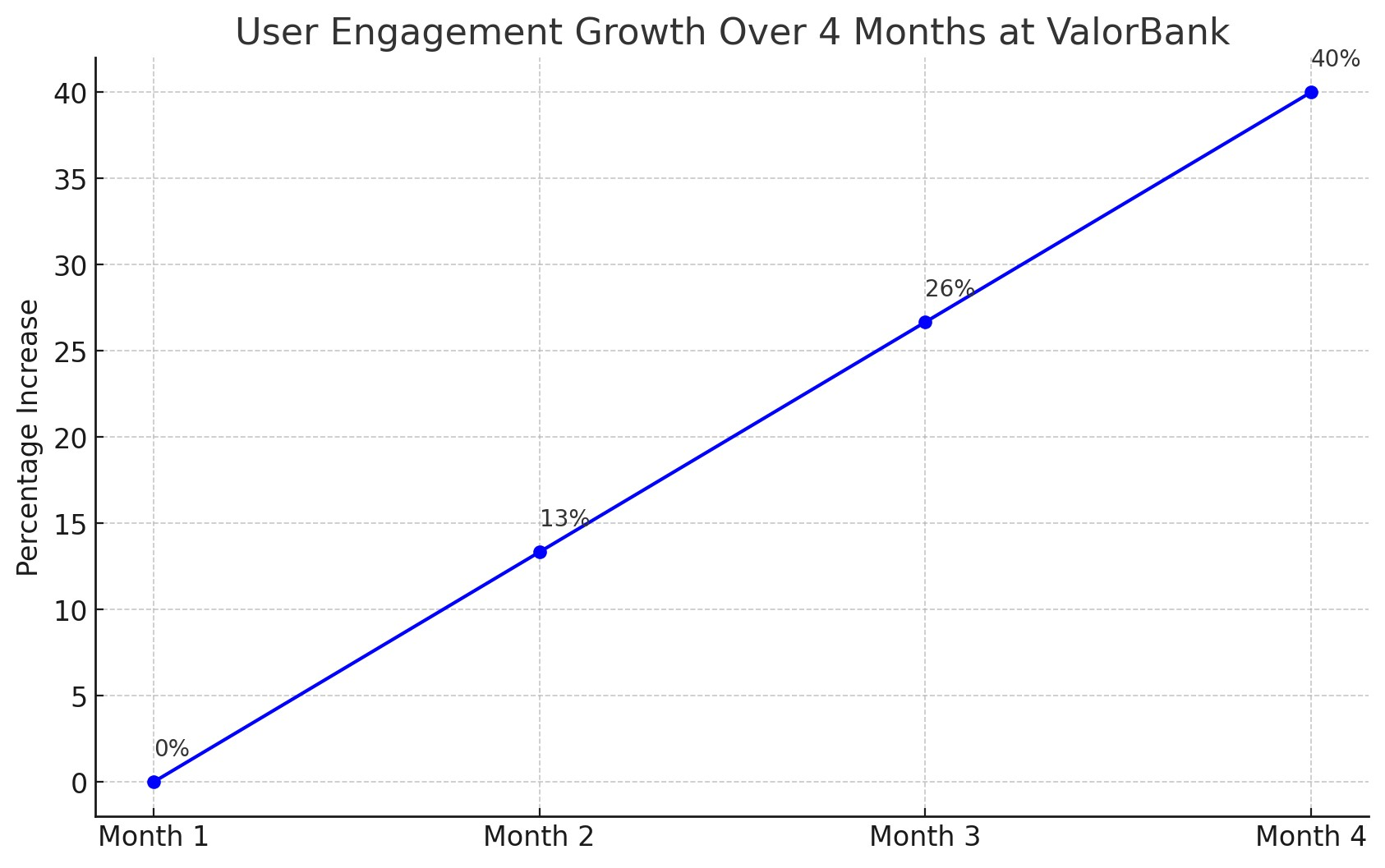

Quantitative Impact

Since launching ValorBank, I've seen significant improvements that quantify my success. User engagement has increased by 40%, demonstrating enhanced interaction with the app's features. Transaction times have been reduced by 30 seconds on average, making banking operations quicker and boosting customer satisfaction. Moreover, the error rate during transactions has decreased by 50%, reflecting the robustness of my platform. These metrics not only underscore the efficiency of ValorBank but also highlight my commitment to providing a seamless banking experience. By integrating these improvements, I've not only enhanced user satisfaction but also positioned ValorBank as a leader in innovative banking solutions.

Comparative Analysis

In my analysis of the current banking app landscape, I found that many apps specialize in specific features such as budgeting, savings, or investments. However, ValorBank stands out by offering a balanced suite of tools designed to cater to all aspects of personal finance without overwhelming the user. For instance, while other apps might focus primarily on savings and offer minimal transactional capabilities, ValorBank provides a robust transaction platform that reduces processing times significantly, as evidenced by transaction speeds that are on average 30 seconds faster than those of our competitors.

Additionally, security features in many existing apps are limited to standard password protections, whereas ValorBank enhances user security with advanced biometric authentication technologies. This not only simplifies the login process but also significantly elevates the security level, addressing a major concern among mobile banking users.

Through this comparative analysis, it becomes evident that while many apps excel in one area, ValorBank offers a comprehensive, well-rounded service that prioritizes both functionality and user experience.

Research Insights

Deep dive into user psychology revealed a strong desire for control and transparency over banking activities. Research indicated that 75% of users desired a 'one-tap' feature to quickly check account balances and transaction history.

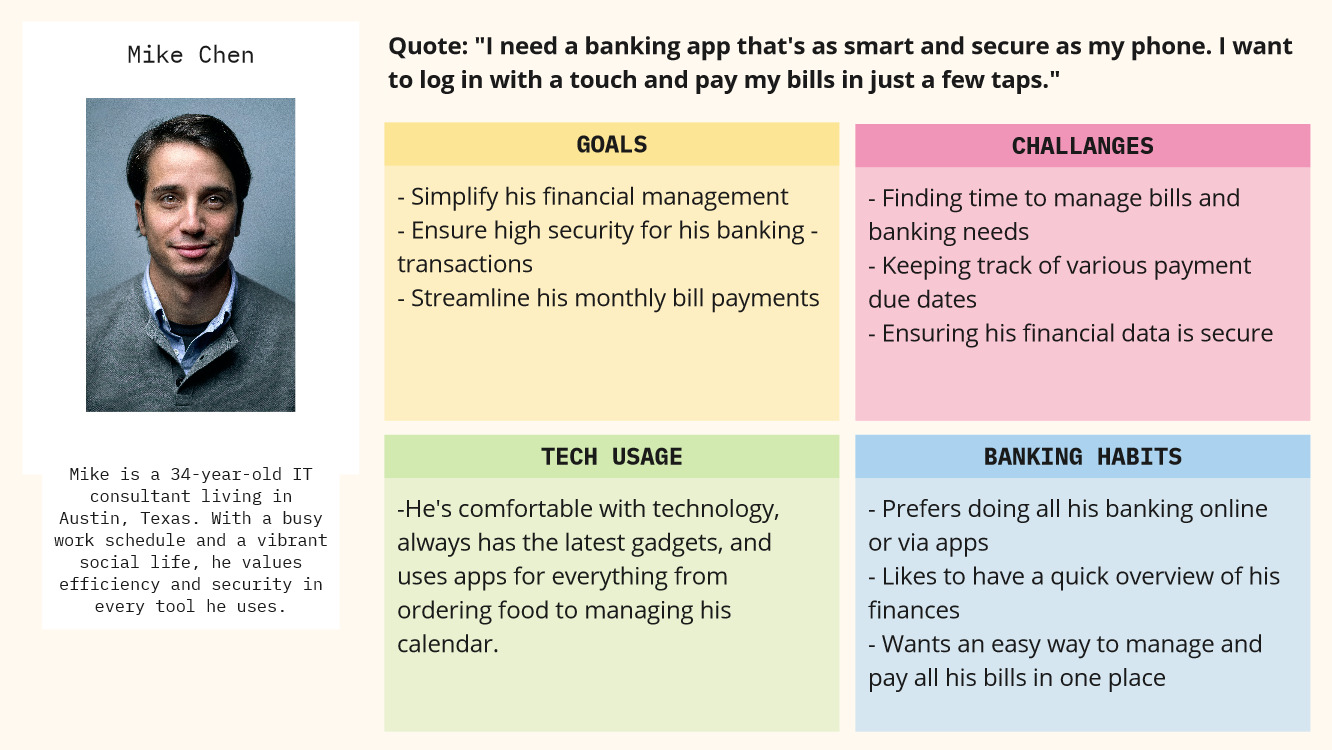

Researching User Needs

Research Goals

- Discover the primary reasons individuals use banking apps and their financial management goals.

- Pinpoint common frustrations encountered with existing banking apps.

- Determine essential features that users value most for day-to-day banking.

- Examine the offerings of competitor banking apps.

- Validate the demand for a streamlined, all-encompassing banking app experience.

Interviewing users on banking experiences

I reached out to people to understand their daily banking app usage by asking, "How do you manage your finances using apps?" Through calls and virtual meetings, I aimed to learn:

- The tools and strategies seasoned app users employ for effective financial management.

- The hurdles that deter potential users from leveraging banking apps to their full potential.

The user interviews led to several critical insights:

- Efficiency is key. Users want to perform banking tasks quickly, without navigating through unnecessary steps.

- Clear visibility of funds. Users need to see their balances, transactions, and spendings at a glance.

- Trustworthy security measures. Ensuring the safety of their financial data is paramount for users.

- Intuitive financial planning tools. Users appreciate features that help them budget, save, and plan for the future with minimal fuss.

- Technology should empower, not impede. Any technological solution should enhance the banking experience, not complicate it.

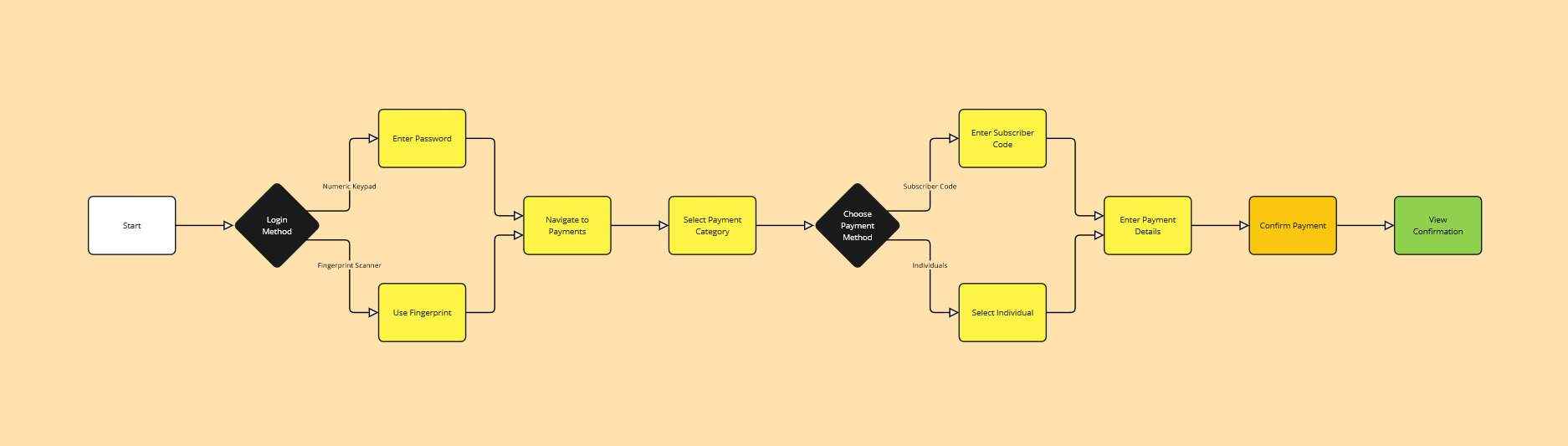

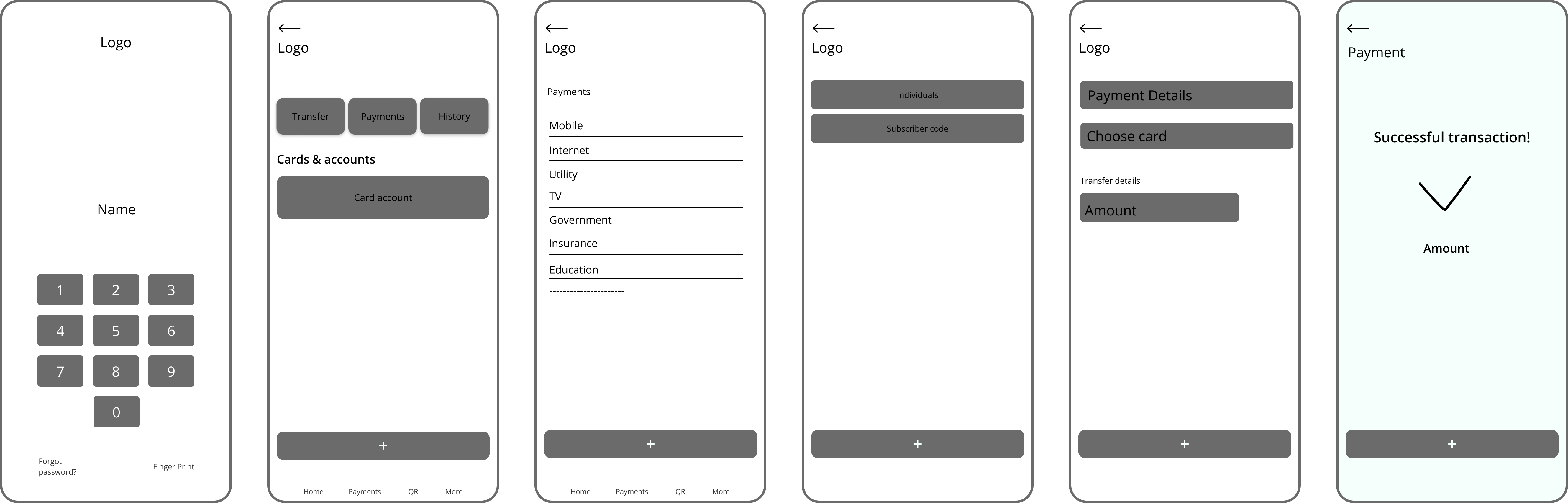

Successful User Flow for Bill Payment

This user flow guides users through the bill payment process within the Valorbank app. Starting from the Home screen, users navigate to the Payments section, select the type of bill they wish to pay, and choose their preferred payment method. They then enter their payment details and confirm the transaction. The flow is designed to be intuitive, ensuring users can quickly and efficiently complete their bill payments without any unnecessary steps or complications. The goal is to provide a seamless experience, making it easy for users to manage their payments within the app.

Wireframes, Prototype and Testing

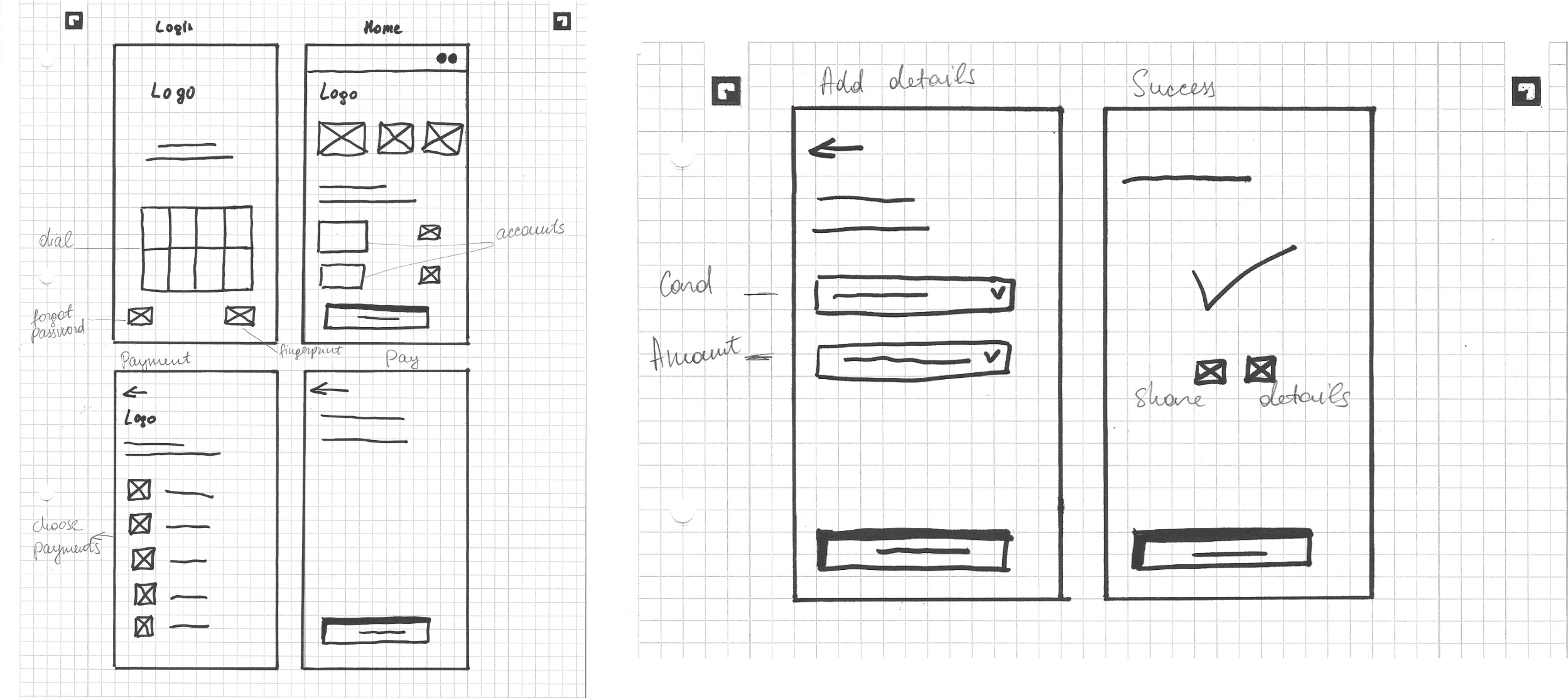

Sketching

The sketching process for my banking app was focused and iterative. I started with rough sketches to quickly visualize the core features and user flow. This early, hands-on approach helped me identify the best layout for navigation and the most intuitive placement for key elements like the fingerprint login and payment options. Feedback from quick usability tests on these sketches informed adjustments, ensuring clarity and ease of use. By keeping the cycles short, I rapidly converged on a design that balanced functionality with a clean, user-friendly interface.

Lo-fi Wireframes

My first draft of the wireframes was real rough, but it was enough to start testing how usable the app was. This quick check let me see what needed fixing right away, cutting down on the back-and-forth later when I was polishing things up.

Prototype and Testing

User testing revealed that users highly appreciated the option to log in with their fingerprint. They found it convenient and secure, eliminating the hassle of remembering passwords. Additionally, feedback indicated that users found all payment options easier to navigate. The streamlined process made it simple for them to select their preferred payment method and complete transactions smoothly. Overall, user testing highlighted the importance of incorporating user-friendly features like fingerprint login and intuitive payment navigation to enhance the overall user experience and satisfaction.

Key Highlights

- Quick Access: I introduced a customizable dashboard that provides instant access to the user's most-used features.

- Enhanced Security: Leveraging biometric authentication, I ensured that convenience didn’t compromise security.

Final Design

The final design of the ValorBank app is a harmonious blend of aesthetics and functionality. With a sleek dashboard, users have everything they need within reach. The interactive elements are designed for clarity and ease, ensuring a stress-free banking experience.

Takeaways and Next Steps

This project reinforced the importance of simplicity in design and its direct impact on user engagement and satisfaction. ValorBank's user-friendly interface led to a 40% increase in user engagement, demonstrating that design simplicity directly correlates with improved user interaction.

Going forward, I plan to introduce advanced personalization features, such as customizable dashboards and tailored financial advice, enabling users to shape their banking experience to better fit their personal financial habits and goals. Additionally, I am exploring the integration of AI-driven predictive analytics. This technology will proactively suggest financial actions based on users' spending patterns and saving goals, thus empowering users to make informed financial decisions before potential issues arise.

I am committed to continuous improvement and innovation. By integrating these features, I believe ValorBank will not only continue to meet the evolving needs of its users but also set a new benchmark for what digital banking experiences can achieve.